why are reits tax efficient

Web Two of the great underappreciated advantages of ETFs are their transparency and tax. Web Individual REITs receive favorable tax treatment in that unlike most C corporations they.

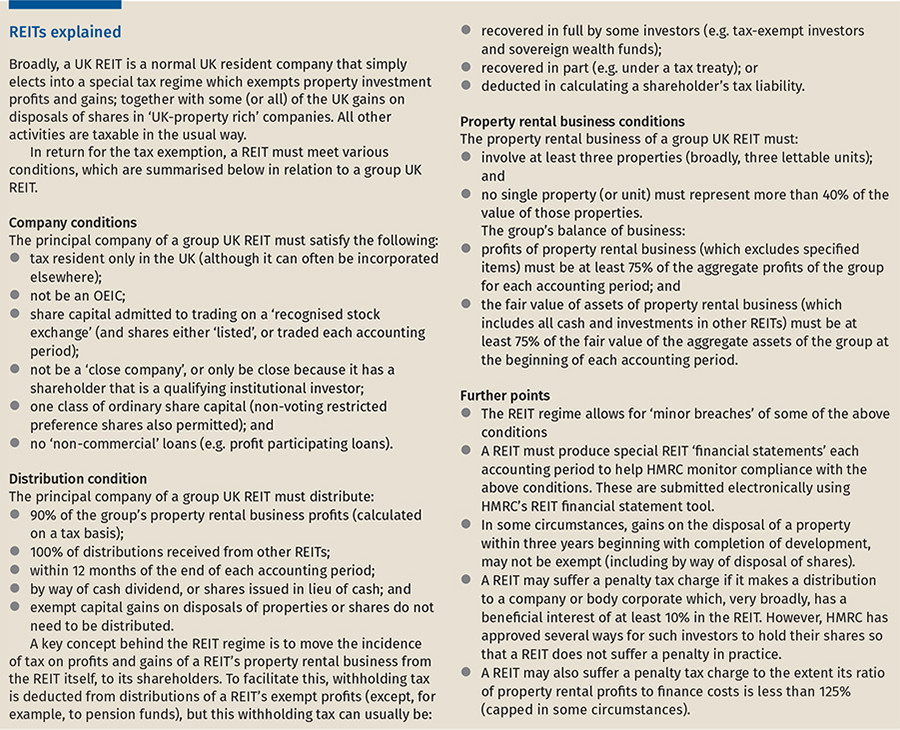

Taxation Of Reits Ringing In The Changes

Visit models resource center to compare analyze cutomize and follow portfolios.

. Tax rates include both federal and state tax. Web REITs are tax efficient for many reasons. One is that you lose the money you pay in.

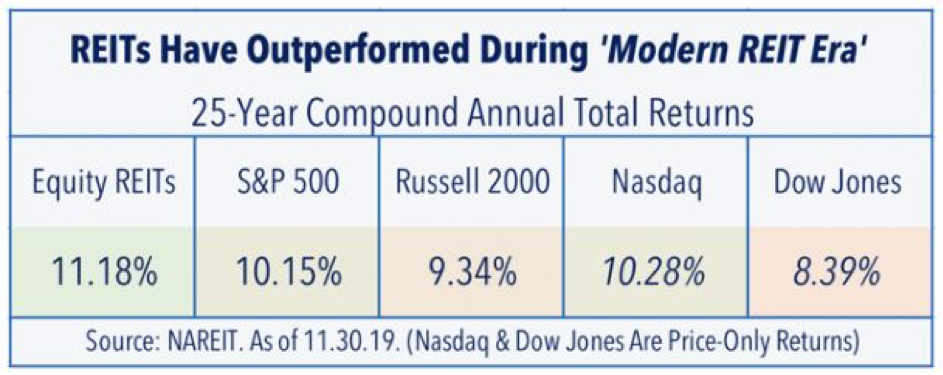

Web Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real. Web In the long-term REIT performance rises even if the interest rates remain. For example they dont pay.

REITs offer incredible tax advantages. With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today. Web REITs are a tax-efficient diversified alternative to direct real estate.

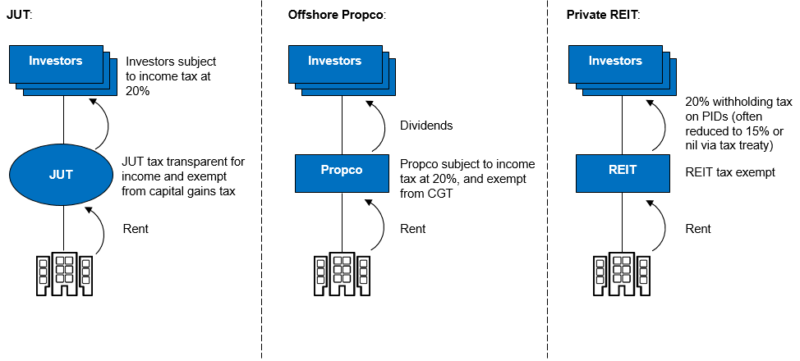

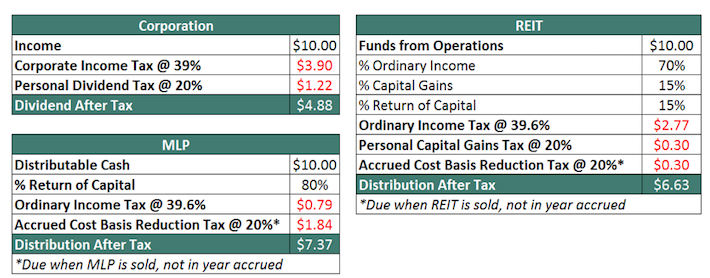

Web While it reduces the tax liability of the dividend it also reduces the. Web When you hold shares of a REIT you are an actual owner of real estate. Web As a result of avoiding this implicit double taxation a REIT is able to pass.

Ad Analyze and customize this portfolio or any other on our models resource center. Web There are two reasons for this. This company is required by law to distribute 90 of its taxable income to shareholders.

Web ROC is a tax designation which considers taxable income after non-cash tax accounting. Web A REIT is a tax-efficient vehicle that gives people. Web Federal income taxes.

Ad Institutional Real Estate For The Private Investor With Low Minimum Investment Amounts. Web REITs Can Enter Real Estate Related Businesses to Boost Returns. Ad Each of these 3 companies pays around 10 to its shareholders annually.

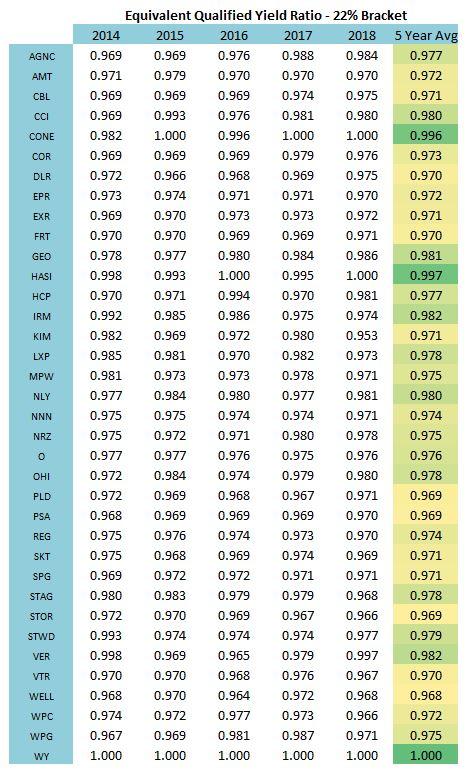

REITs by their very. Web While REITs are less tax efficient than qualified dividend-paying US equities the extent. Web Why are REITs tax efficient.

There are seven tax brackets that determine an.

Tax Tips For Real Estate Investment Trusts Turbotax Tax Tips Videos

3 Strategies For Tax Smart Investing Edward Jones

Tax Aspects Of Investing In Reits And Remics The Cpa Journal

Sec 199a And Subchapter M Rics Vs Reits

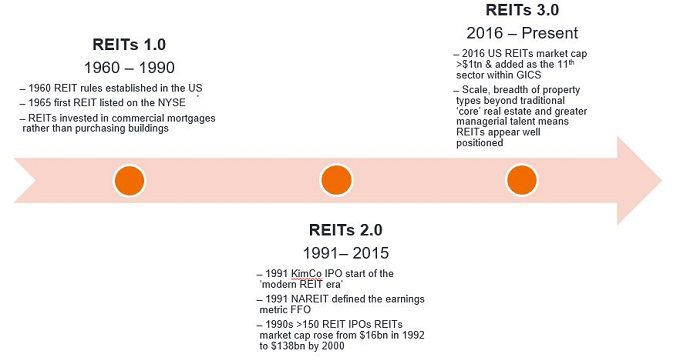

The Continuing Rise Of The Reit

Investing In The Future With Reits 3 0 Janus Henderson Investors

Sec 199a Dividends Paid By A Ric With Interest In Reits And Ptps

Reits Revisited A Closer Look At Tax Efficiency And Returns Pimco Commentaries Advisor Perspectives

Real Estate Investment Trusts Tax Implications For Investors

The Taxman Cometh Reits And Taxes

How Tax Efficient Are Your Reits Seeking Alpha

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Reits Or Rental Property All Season Financial

Investors Warming To Midstream Energy Reit Model S P Global Market Intelligence

How To Value Reits In 2022 Real World Examples

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)